TikTok, is just for silly dances…right? Wrong and I’ll tell you why.

Back in March 2021 I introduced to you the recent social media phenomenon TikTok and shared the ins and outs to ‘StockTok’ - a portmanteau of ‘Stock’ + ‘TikTok’ covering a theme of videos discussing stocks and investing. If you have absolutely no idea what I am talking about and missed the first edition of all things finance on TikTok, click here for a recap.

In social media everything changes at a supersonic pace, so in this month’s TikTok edition I will be showcasing why people are so interested in getting their financial fix from the app and the potentially stark danger this may pose.

We have incredibly short attention spans. Seriously, we do.

Throughout the pandemic, it’s been hard to cut through the noise and keep engagement rates high and that is where these wonderous 60-second videos have started to shine. Firms have continued serving their clients with an array of information but how much is too much?

A good analogy is the taxi vs. Uber conundrum.¹ Right up until Uber arrived, to be a taxi driver you had to have taken various tests and held certain licenses and so forth. Overnight, Uber changed everything and enabled any individual with a driving license to suddenly be a taxi driver. This example shows how the social media landscape can and has changed society. It also extends to absorbing content/information.

People don’t have the time or desire to watch 30-minute videos, instead they are longing for something quick and catchy. This is why TikTok has taken the social media space by storm.

Corporate firms are joining the bandwagon… I present to you, Fidelity.

At time of writing Fidelity has a substantial 833 followers. It might not be huge but everyone has to start somewhere. Here comes the fun part. I am not joking when I tell you that Fidelity is teaching its audience what a mutual fund is by comparing it to a burrito with various fillings.

Fidelity's “Money Kitchen” series² is showing how funds can provide diversification by comparing something traditionally complicated to understand, with food. It’s quite clever really. Their channel is an educational channel that is safely enabling younger adults to get to grips with investing terms and concepts. Here is a link to their channel if you are super curious.

What about the nightmare side of TikTok?

While my earlier points are positive reasons behind why stock TikTok is actually rather appealing and successful, we mustn’t forget the importance of regulation. This is something that the Financial Conduct Authority (FCA) have started to keep close tabs on.

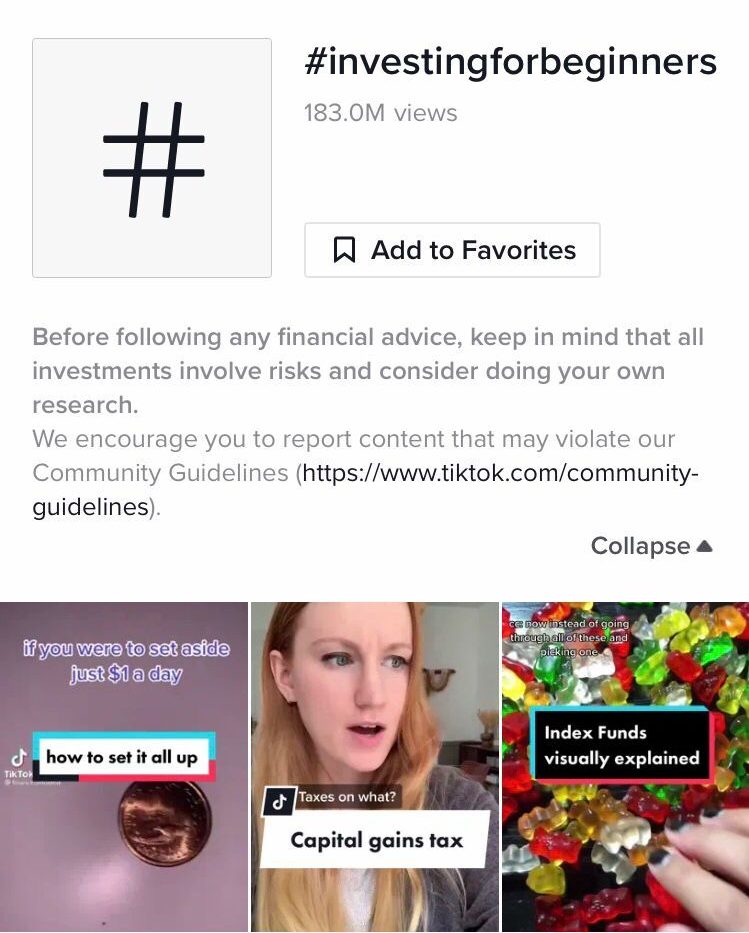

Recently, TikTok banned the promotion of various financial services products including investments and cryptocurrency.³ If you are on the app and type in #investingforbeginners or #crypto, you are served with a small ‘disclaimer’ (see image below).

While this type of wording encourages the safe sharing of content, are people really going to report content that violates its community guidelines? Probably not. Dare I say it, #investingforbeginners currently has over 182.7M views, essentially making it impossible for TikTok to rigorously review and approve all the content in these videos.

Stock TikTok: is it a dream or a nightmare?

I think it is fair to say that we are entering uncharted territory. It is clear to see the TikTok app can potentially have an incredible impact on the spread of financial knowledge. However, there is no denying a need for regulators to keep up with technology given the obscene amount of financial ”advice” that can be shared.

Will we see an FCA TikTok channel next? If they want to help the kids, perhaps they’ll need to get down with them.

Sources

¹https://financialadvisoriq.com/c/3289544/419804/tiktok_financial_literacy_advice_seconds_less

²https://www.ignites.com/c/3291994/417663

³https://www.ftadviser.com/your-industry/2021/07/08/tiktok-bans-investment-promotions/